Health Insurance for Individuals

As an individual, select from options for yourself and your family. All plans offered through the ASID Member Health Program are ACA-qualified polices with options to use national PPO networks, co-pays, deductibles, and out-of-pocket maximums.

Major Medical Insurance for Individuals

Learn MoreOptions on the Marketplace

Learn MoreSupplemental Insurance for Individuals

Learn MoreMajor Medical Insurance for Individuals

MAJOR MEDICAL INSURANCE POWERED BY CLEARWATER

Smarter Care. Lower Costs.

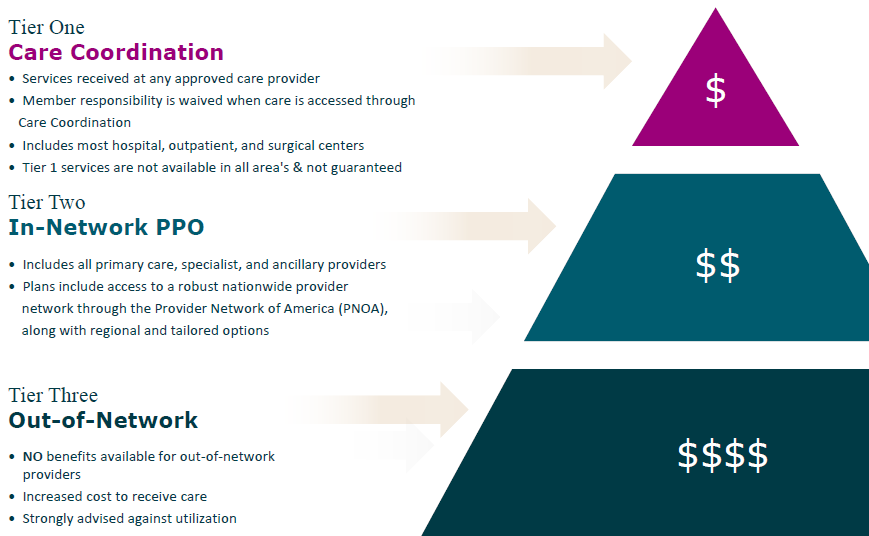

With the Clearwater Major Medical Plan by TRIDENT, you're never on your own. A personal Care Advocate helps you find high-quality, low-cost providers - often bringing your care down to $0. It's proactive coverage that rewards smart choices.

Who is Eligible?

ASID members who are individuals looking for coverage for themselves and their family, and small business owners who'd like an individual policy option for their employees.

How it works

These benefits were developed to help low utilizers secure protection for major expenses and drive their out-of-pocket expenses lower by seeking direction from the Care Coordination Team. Enrollment is available year-round and when you enroll, your insurance coverage will be effective on the first of the month following your application date. Each year your plan will renew January 1.

Plans through TRIDENT are guaranteed issue and cover pre-existing conditions; however, your current providers, treatments and medications may not be covered under the plan. To ensure continuum of care and avoid treatment disruption, all applicants will complete a health questionnaire which will be reviewed by an underwriter. If you have a medical condition please schedule a call with one of the Arcwood Benefit consultants before enrolling.

What are the benefits of the Clearwater Major Medical Plan?

- The TRIDENT Co-Pay plans introduce a tier of benefits where you can pay $0 for major services like out-patient hospitalizations, imaging, mental health, and urgent care when working with the Care Advocacy team.

- Premiums are age rated giving individuals younger than 45 with low utilization the opportunity to have a reduced premium compared to other major medical policies.

- Without a hospital network ("open network"), the Care Coordination team works to recommend a fair priced, high quality provider.

- A National EPO Network for professional services (non-facility) through 6 Degrees Health. (An EPO does not have out-of-network benefits)

- Prescription coverage for Generic and common Brand drugs for $0 in the Copay plans.

- No cost Virtual Care through AMAZE Health

View Rates

Schedule A Call Today

PLEASE REVIEW OUR FAQ BELOW

What Are The Plan Designs?

What is the Network?

How does the Prescription Plan work?

How do I enroll?

Options on the Marketplace

Some individuals can have their health insurance expense reduced from the Affordable Care Act (ACA). Based on an income test, you could qualify for a premium subsidy for policies purchased on the Health Insurance Marketplace.

Please Note: The Enhanced tax credits established by the American Rescue Plan Act, and extended by the Inflation Reduction Act are set to sunset December 31, 2025; however, there are still tax credits available for individuals making less then $62,600 (families of four $128,600).

How It Works

In the fall of each year during Open Enrollment select a policy available on the Health Insurance Marketplace. Alternatively, select a policy if you have a qualifying event.

These options are guaranteed and do not require qualification or evaluations to issue the policy.

As an individual, you pay the policy premium using post-tax dollars.

You own the policy as an individual, and your policy is portable, regardless of where you work.

These are defined as Major Medical Policies.

Shop The Marketplace

Supplemental Insurance for Individuals

Through Clearwater Health, supplemental insurances such as critical illness and an accident plan, are available as added benefits and can be bundled with the major medical plan.

Options are available for individuals who are not incorporated. If you are a sole proprietor who has an Employer Identification Number (EIN) issued by the IRS, you are also eligible for options available for Businesses.

CRITICAL ILLNESS

Critical Illness supplemental benefit provides additional coverage for medical emergencies like heart attack, stroke, invasive cancer or ESRD. Critical Illness will pay a lump sum benefit as shown in the schedule upon the first diagnosis of a covered condition for each incident (including reoccurrence). Benefits are paid directly to the primary member and can be used however they choose.

ACCIDENT INSURANCE

The Accident supplemental benefit pays up to the scheduled maximum amount, after the deductible, for medical charges resulting from a covered accident. The scheduled benefits apply to each accident per person covered, not to exceed the Maximum Amount Per Accident. The maximum amount applies to each accident (regardless of plan year) subject to the Plan Year Maximum. Reimbursements may reflect actual expenses up to the benefit amount indicated in the schedule. Benefits are paid directly to the primary member and can be used however they choose

Program Partner

Design Business by ASID program partners; Arcwood Benefits Consulting, Inc. as an insurance consultant and Arcwood Financial as a 401(k) advisor and consultant, dba Arcwood®, will assist ASID members in reviewing program options and comparing them with other insurance plans and retirement plan vendors. Arcwood is also available to conduct pricing and plan design analyses for ASID members with existing plans and larger businesses.